Recruitment

Post jobs quickly, keep your candidate base healthy, and fill roles faster with offshore recruitment support.

See Recruitment roles

See Recruitment roles

Build your own high-performing team in South Africa or the Philippines.

Use our world class offices. Enjoy end-to-end support.

Pick your team, get to work, and leave the rest to us

Outsource any professional services role across any industry

We operate in leading global markets to help you find highly qualified, experienced, English-proficient talent.

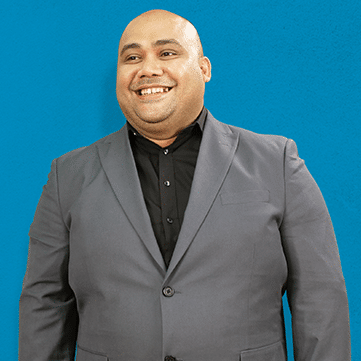

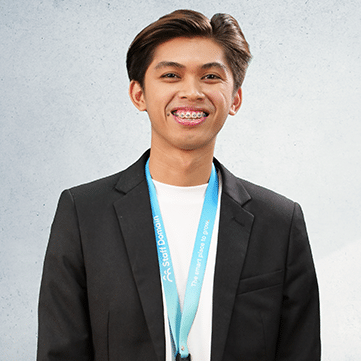

Unsure what to expect? Meet some of the outstanding staff working alongside our team and clients

10+ Years of Experience

Inbound and Outbound Calls, Customer Service, Australian & US Work Experience, B2B B2C Sales, Pipeline Management

15+ Years of Experience

Administrative Duties, Appointment Scheduling, Upper-Level Business Diplomacy Tasks, Training Needs.

10+ Years of Experience

Prospecting, Cold Calling, Proposals, Service Agreements, Client Relationship Management, Negotiations, Business Strategies.

18+ Years of Experience

Production Processes, Project Planning, Managing Client Accounts, Managing Service Deliveries, Business Development.

10+ Years of Experience

Tax Returns, Superannuation Fund Preparation, Trust Financials, Bookkeeping, MYOB/Xero/Quickbooks qualified.

9+ Years of Experience

Sourcing, Candidates Screening, Candidate Interviewing, Market Research

14+ Years of Experience

AU Experience, Psychology, IT Recruitment, Executive Recruitment, Building Candidate Pipelines, LinkedIn Recruiter, Screening, Conducting Interviews

12+ Years of Experience

SA and US Experience. Develop, implement, and lead marketing activities, generation and execution of marketing plans and automation. Bachelor of Arts in Media Studies and International Relations.

5+ Years of Experience

Monthly Creditor Reconciliation, Income Statements, Audit Journals, Billing Queries.

8+ Years of Experience

Sourcing Candidates, Customer Service, Client Servicing, Negotiation of Salaries, Assessing Candidates, Building Candidate Pipelines

8+ Years of Experience

Technical Support, Answering Emails and Phone Calls, Live Chat Support, Complaint Resolution, Australian Work Experience

5+ Years of Experience

Level 1 Tech Support, Customer Service, Phone & Email Support, Troubleshooting, Global Work Experience

10+ Years of Experience

Inbound and Outbound Calls, Appointment Scheduling, Customer Service, Australian Work Experience, B2B & B2C Sales

5+ Years of Experience

Sourcing Strategies, Pipeline Management, Candidate Screening, Applicant Tracking, Experience with Iconic Global Brands

Staff Domain is proud to be a trusted offshore outsourcing partner to businesses worldwide

“The idea was that through a blend of offshore and onshore staff we would be able to increase our capacity and have more time for clients. Staff Domain have helped us a build a high-performing team of 3 recruiters in the Philippines to take on candidate-focused work. They’re smashing their KPIs and have helped our local team find more time for client servicing.”

“Martina is thorough, accurate and picks things up very quickly. I review all her work, but I have a lot of confidence because I don’t pick up on many errors. In fact, sometimes she can be even more detailed oriented then myself! When I give her a task, I know she’ll get it done to the best she can.”

Subscribe for the latest trends, best practices, and strategies for global teams